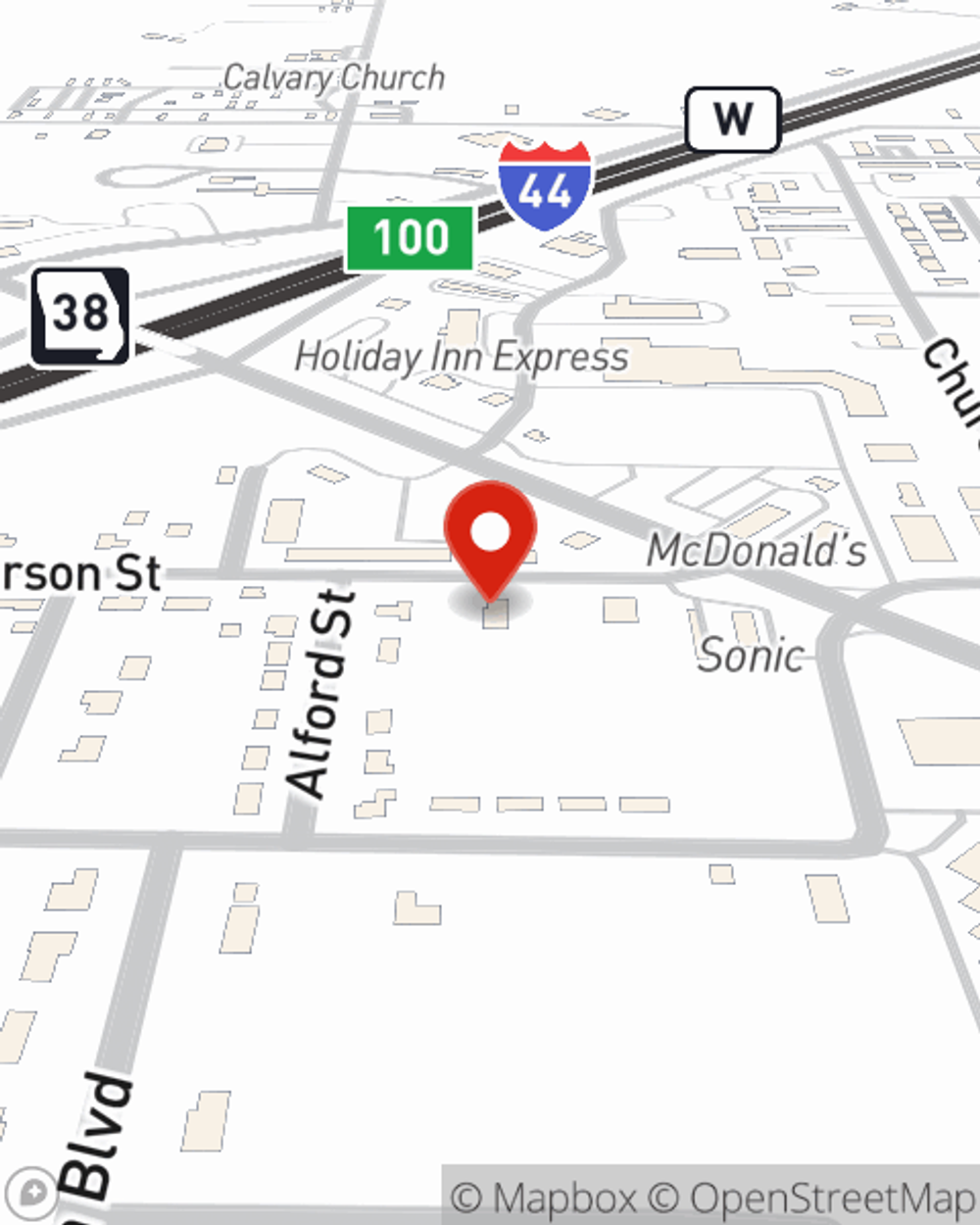

Insurance in and around Marshfield

Multiple ways to help keep more of your hard-earned dollars

Insurance that works for you

Would you like to create a personalized quote?

Find The Insurance Protection You Need At State Farm.

Wondering how you can help protect yourself, your loved ones, and the life you've built in a world that often throws the unexpected at you? Ask agent Tony Di Trolio how you can construct a Personalized Price Plan® that's right for you. And while you're at it, check out State Farm's safe driving rewards, bundling options and discounts!

Multiple ways to help keep more of your hard-earned dollars

Insurance that works for you

Insurance Products To Meet Your Ever Changing Needs

State Farm may be able to help with great claims service, outstanding coverage options, and competitive prices for when the unexpected happens.

Simple Insights®

What is liability insurance coverage?

What is liability insurance coverage?

Discover what liability car insurance covers, why it's required in some states and how it can help protect you financially if you are involved in a crash.

Tony Di Trolio

State Farm® Insurance AgentSimple Insights®

What is liability insurance coverage?

What is liability insurance coverage?

Discover what liability car insurance covers, why it's required in some states and how it can help protect you financially if you are involved in a crash.